Getting Past the Virtualization Crossroads

Is the Broadcom / VMware acquisition making you take stock?

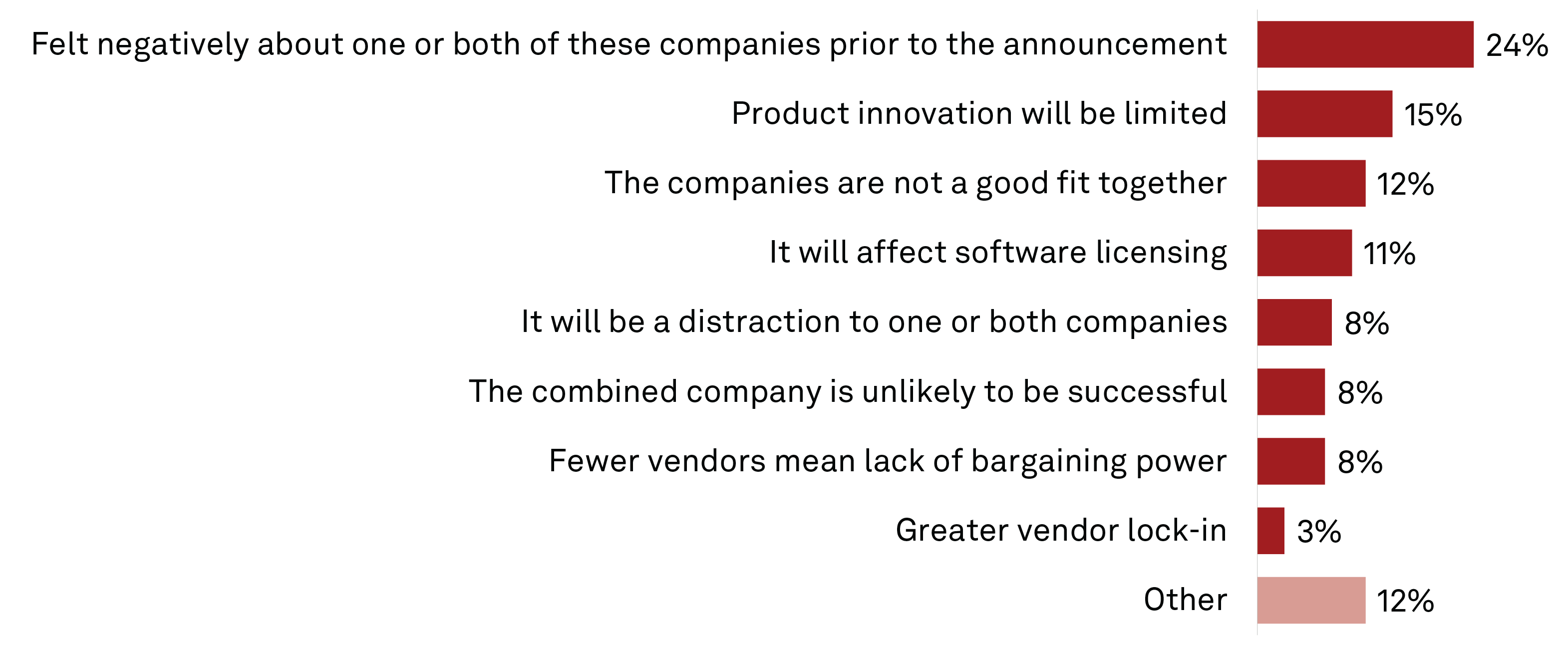

The numbers are in and yes, the Broadcom VMware acquisition is creating plenty to evaluate. Largely prompted by considerably more expensive pricing models, particularly for small to medium-sized businesses, IT leaders are taking stock of their IT assets and debating the details of a smaller VMware footprint.

The Crossroads Defined: Stay or Go?

Continue with VMware, adapting to its new pricing and policies under Broadcom, or explore other technology platforms that may offer more flexibility and potentially lower costs, despite the challenges of moving away from these integrated systems?

Let’s take a look at some of the considerations that are guiding decisions out there.

- New pricing. While the new Broadcom situation does come with a new pricing models, it’s not the only factor, but it’s certainly a big one.

- Reliable Support. This is especially relevant for smaller organizations that require more robust support.

- T&Cs. The synergies between VMware and Broadcom and impact on software licensing terms and conditions.

- The cost to switch. High costs and operational interruptions make it harder to switch to other vendors.

- The promise of AI. With AI-lead advancements, this may be a good time to reconsider the tech landscape.

The Five Key Considerations

Ergonomic Group has come up with five key considerations to help you evaluate your next moves in the new virtualization reality:

- Some customers have reported a ten-fold increase in associated costs.* How does this compare with your situation?

- Explore alternative virtualization platforms and test them.

- Consider a container-based approach and complete a cost-benefit analysis.

- Optimize your licensing and subscription agreements with VMware if you stay with them.

- Consider a hybrid cloud strategy. This will give you the much-needed flexibility to integrate virtualization technologies from different vendors.

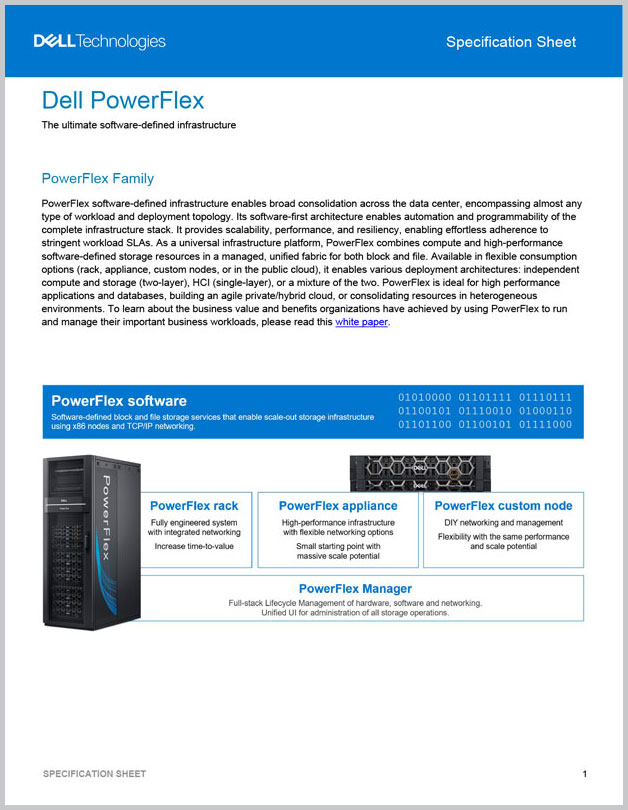

The Solution to Ease the Transition: Dell’s PowerFlex

As you navigate the complexities introduced by Broadcom’s acquisition of VMware, futureproofing your IT infrastructure becomes increasingly critical. It demands a long-term strategy that integrates emerging technologies like AI, advanced analytics, and automated management systems.

As a Dell Titanium Partner, it’s our pleasure to implement successful PowerFlex deployments to ensure resilient, future-proof solutions that are optimized for growth. PowerFlex is a dynamic and adaptable software-defined infrastructure meticulously crafted to modernize IT landscapes, increase business agility, and expertly handle modern workloads’ intricacies.

Here are just a few resources for your consideration

And, when you’re ready to talk, Ergonomic Group is waiting for you. Just book your discussion today.

*Methodology: This online survey of 338 respondents was conducted from May 27 through June 3, 2022, by 451 Research, the enterprise technology research unit of S&P Global Market Intelligence. "Don't break VMware," customers ask of Broadcom in our new Digital Pulse survey | S&P Global Market Intelligence (spglobal.com)